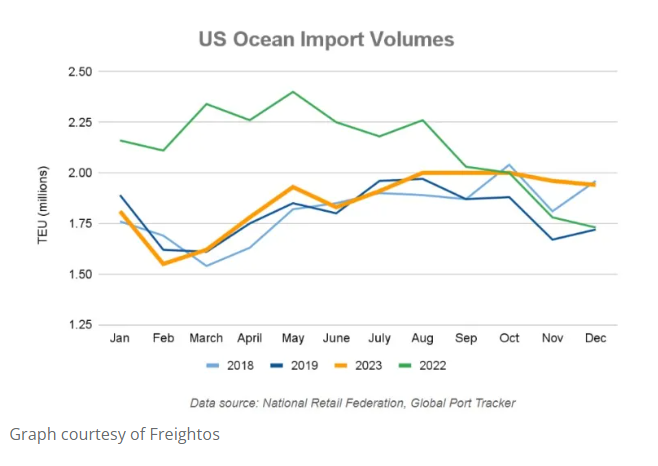

The latest National Retail Federation U.S. ocean import report projects that the relative volume strength – about two million TEU – estimated for August will persist through October, reflecting increased optimism among importers for consumer strength over the holiday season, according to freight marketplace Freightos.

These projections have September and October volumes 6-7 percent higher than in 2019, followed by only a moderate dip in November and December, with volumes about 15 percent higher than pre-pandemic. This late Q4 strength would be a possible sign of a general restocking cycle, as these goods would arrive too late for the holidays.

Recent data from the electronics industry show signs of hope that demand for components and end-products will rebound by the end of the year.

Volume trends

Freight volumes have slowly been increasing, according to data collected by Descartes’ global trade software Descartes Datamyne. U.S. container import volume in August increased slightly compared to July 2023, which is fairly consistent with the rise that occurs in peak season in non-pandemic years. Despite the volume increase, port transit times remained close to their lowest levels since Descartes began tracking them.

Following the resolution of a labor dispute, West Coast ports have gained market share, Descartes said. The West Coast Ports of Los Angeles and Long Beach showed the greatest overall container volume increases, while the Ports of New York/New Jersey and Savannah had the greatest decreases.

While the drought in Panama is affecting some shipping traffic, U.S. container import volumes do not appear to be impacted. Volumes at the Gulf ports over the last two months have been at their highest levels this year and transit times have been consistently low.

Chinese imports in August 2023 grew, Descartes reported: There was an increase by 1.5 percent over July 2023, but they were still down 17.1 percent from the August 2022 high. China represented 37.9 percent of the total U.S. container imports in August, a slight bump of 0.4 percent from July, but still down 3.6 percent from the high of 41.5 percent in February 2022.

Rate trends

Carriers have been struggling to stabilize or increase rates, according to Freightos. Transpacific rates to the West Coast have come down slightly — about 7 percent in September — and prices to the East Coast have been about level. This relative stability in September – though these rates, even with elevated volumes, are still partially facilitated by significant capacity restrictions by carriers – could point to the consistency in volumes projected by the NRF and the possibility of a moderate but sustained peak through October.

But easing rates – even slight declines – in the weeks just before Golden Week when there’s typically upward pressure on prices, together with many anecdotal reports of decreasing ocean bookings, point the other direction, said Freightos.

In a recent market update webinar, Robert Khachatryan, CEO of freight forwarder Freight Right Logistics, said that many customers are reporting “drops in orders and expectations of a drop in consumer spending in Q4,” and that falling freight rates ahead of Golden Week only add to skepticism that this year’s peak will persist through September or beyond.

If demand is easing as capacity continues to increase, carriers will face further challenges to keep rates elevated.

The overcapacity in the market is forcing some to idle new ultra large vessels even before their maiden voyages from Asia to Europe. Rates on this lane fell 8 percent last week to $1,608/FEU, said Freightos, although prices remain slightly above 2019 levels. In response, carriers are announcing additional blanked sailings even in the weeks after the Golden Week holiday, suggesting that demand is expected to decrease in the weeks that are typically Asia – N. Europe’s peak season period.

Though ocean volumes reportedly remain strong for Asia – Mediterranean trade, rates are falling. This decline is likely driven by carriers adding too much capacity in recent months as demand proved resilient; they are now removing capacity to try and match volumes.

Carriers likewise shifted too many vessels to transatlantic trade for much of this year even as volumes declined, and prices have been falling for much of the past year as a result. Freightos found rates fell another 7 percent last week to less than $1,100/FEU – 45 percent lower than in 2019 – and carriers have announced a significant increase in blanked sailings to try and push rates back up.

Signs of a muted ocean peak season are leading to pessimism about the strength of air cargo’s peak season in the coming months, Freightos concluded. In the meantime, Khachatryan reports seeing “some uptick in demand for transpacific air bookings in the last few weeks,” which, together with the sluggish rebound of tourism in China not adding as much passenger capacity compared to many other regions, may account for the 37 percent increase in China – N. America Freightos Air Index rates to $4.78/kg since early August.

Original from EPSNews - Isuued on , By News Desk

Post time: Sep-14-2023